The Role of Insurance Small and can have devastating consequences for businesses, particularly small businesses that often lack the resources to withstand the financial impact. From hurricanes and floods to wildfires and earthquakes, the threat of natural disasters is a reality that small business owners must confront. In such a volatile environment, insurance plays a crucial role in helping small businesses protect themselves from the financial fallout of these catastrophic events. This article explores the importance of insurance for small businesses, the types of insurance available to protect against natural disasters, and the ways in which small businesses can effectively prepare for the unexpected.

1. The Vulnerability of Small Businesses to Natural Disasters

Small businesses are the backbone of many economies, yet they are often the most vulnerable when it comes to natural disasters. Unlike large corporations, small businesses typically operate with tighter margins, fewer resources, and limited access to capital, which makes it harder for them to recover from unexpected disruptions.

- Financial Impact: Natural disasters can result in significant physical damage to business property, inventory, equipment, and infrastructure. In addition, the costs of business interruption, loss of revenue, and employee downtime can further strain the financial health of a small business.

- Lack of Preparedness: Small businesses may not have the resources to implement disaster recovery plans, invest in preventive measures, or purchase adequate insurance coverage. This leaves them more exposed to the risks of natural disasters, which could potentially lead to closure or bankruptcy.

- Long Recovery Times: Even after a disaster, small businesses often face lengthy recovery periods, making it more difficult for them to get back on their feet. Without the proper insurance coverage, the recovery process becomes even more challenging, especially if the business does not have sufficient savings or access to financial aid.

2. The Importance of Insurance in Disaster Protection

Insurance serves as a safety net that allows small businesses to absorb the financial shock caused by natural disasters. It can help businesses cover the costs of property damage, business interruption, liability claims, and more. Without insurance, small businesses may be forced to shut down permanently after a disaster, as the costs of rebuilding and restarting could be overwhelming.

2.1 Protection of Physical Assets

Physical assets are often the most vulnerable in the face of natural disasters. Property damage caused by hurricanes, floods, wildfires, or earthquakes can disrupt business operations and require costly repairs or replacements. Insurance provides businesses with the financial means to recover from such damage.

- Property Insurance: Property insurance helps cover the cost of repairing or replacing physical assets, including buildings, equipment, inventory, and machinery. It can also protect against losses resulting from theft or vandalism during or after a natural disaster.

- Flood Insurance: Many standard property insurance policies do not cover flood damage. Small business owners located in flood-prone areas should consider purchasing separate flood insurance to safeguard against the risk of water damage caused by heavy rains, rising rivers, or storm surges.

- Earthquake Insurance: Earthquakes are another risk that many small business owners overlook, particularly in seismic zones. Earthquake insurance can help businesses rebuild if they suffer structural damage to their premises or property.

2.2 Business Interruption Insurance

Business interruption insurance, also known as business income insurance, is one of the most critical forms of coverage for small businesses. This insurance is designed to replace lost income and cover operating expenses during periods when the business is unable to operate due to a natural disaster.

- Coverage for Lost Revenue: If a business is forced to close temporarily due to a natural disaster, business interruption insurance can replace the lost revenue for a specified period. This ensures that the business can continue to cover expenses such as rent, utilities, and salaries, even if operations are halted.

- Temporary Relocation Expenses: In some cases, small businesses may need to relocate to a temporary facility while their main location is being repaired. Business interruption insurance can help cover the cost of leasing temporary space, maintaining operations, and keeping customers engaged during the recovery period.

2.3 Liability Protection

The Role of Insurance Small, businesses may face claims for damages or injuries sustained by third parties, such as customers, employees, or vendors. Liability insurance can help protect small businesses from legal costs and settlements associated with these claims.

- General Liability Insurance: This type of insurance provides protection against bodily injury, property damage, and other third-party claims that may arise during or after a natural disaster. For example, if a customer is injured while visiting the business premises during a hurricane or flood, general liability insurance can help cover medical expenses and legal fees.

- Workers’ Compensation Insurance: In the event of an injury to an employee while working during or after a natural disaster, workers’ compensation insurance ensures that the business provides coverage for medical treatment, lost wages, and rehabilitation costs.

2.4 Protecting Inventory and Equipment

The Role of Insurance Small heavily on inventory and equipment, the loss of these assets during a natural disaster can be financially catastrophic. Insurance policies can protect small businesses from the risk of losing valuable inventory and equipment.

- Business Property Insurance: As mentioned earlier, this insurance covers physical property, including inventory and machinery, against risks such as fire, theft, vandalism, and damage caused by natural disasters. It can provide financial support to replace or repair damaged assets.

- Equipment Breakdown Insurance: In addition to protecting property, businesses that rely on machinery and equipment for their operations can benefit from equipment breakdown insurance, which covers repair costs if equipment is damaged or malfunctioned due to a disaster.

3. Types of Insurance Coverage for Natural Disasters

When preparing for the risks posed by natural disasters, small business owners should consider various insurance policies that provide comprehensive protection. These policies can be customized to address specific threats, depending on the location and industry of the business.

3.1 Commercial Property Insurance

This is the most basic form of insurance for protecting a business against natural disasters. It covers damage to the physical premises, equipment, and inventory due to events such as storms, fires, and theft.

3.2 Flood Insurance

Given that floods are a common cause of damage, especially in coastal or flood-prone areas, small business owners need to ensure that they have adequate flood insurance coverage, which is typically not included in standard commercial property insurance policies.

3.3 Earthquake Insurance

For businesses located in seismic zones, earthquake insurance is essential to protect against the financial fallout of earthquake-related damage, including structural damage to buildings, equipment, and other assets.

3.4 Windstorm Insurance

Windstorms, hurricanes, and tornadoes can cause extensive damage to business property. In some cases, this coverage may be offered as part of a property insurance policy, but businesses located in areas prone to such disasters should confirm the extent of their coverage.

3.5 Business Interruption Insurance

As discussed earlier, business interruption insurance ensures that businesses can continue operations and cover essential expenses during periods of shutdown caused by a natural disaster. This type of coverage is essential for businesses that rely on consistent cash flow.

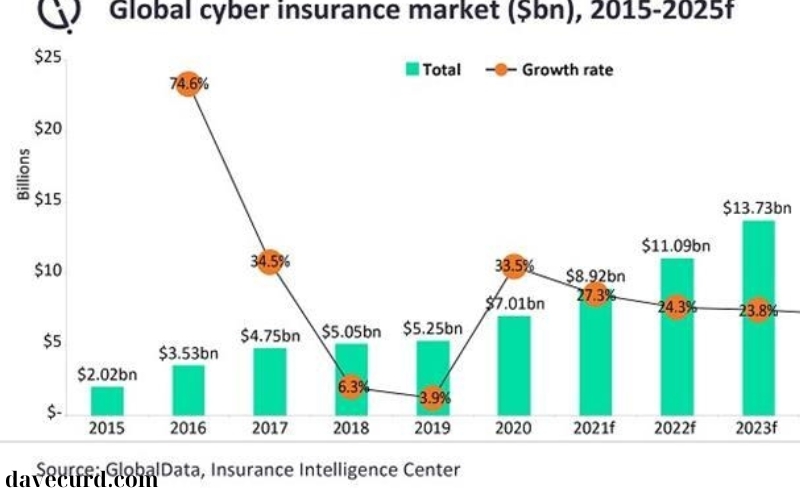

3.6 Cyber Insurance

The Role of Insurance Small, small companies should consider cyber insurance, particularly if their operations rely on digital platforms or data storage. Natural disasters can also increase the risk of cyberattacks or breaches, as businesses become more vulnerable to hacking during periods of disarray.

4. Challenges Small Businesses Face in Securing Insurance

Despite the benefits of insurance, many small business owners face challenges in securing comprehensive coverage. Some of the common obstacles include:

4.1 High Premium Costs

The cost of insurance premiums can be a significant burden for small businesses, particularly those located in high-risk areas. Natural disaster coverage, especially for flood or earthquake damage, may come with steep premiums, making it difficult for businesses to afford comprehensive protection.

4.2 Limited Coverage Options

Small business owners may find that their insurance policies offer limited coverage for certain types of disasters. For example, standard property insurance may not cover specific hazards like earthquakes or floods, requiring businesses to purchase additional coverage.

4.3 Understanding Policy Details

Insurance policies can be complex, and small business owners may struggle to understand the terms and conditions of coverage. It’s essential for businesses to carefully review their policies, ask questions, and work with an insurance agent to ensure that they have the right coverage for their specific needs.